WoW Season of Discovery Fishing Guide: A Comprehensive Approach (Updated 03/09/2026)

Welcome, adventurers! This guide details maximizing profits and efficiency in Season of Discovery fishing, covering locations, gear, mechanics, and lucrative opportunities.

Season of Discovery (SoD) introduces a revitalized fishing experience in World of Warcraft Classic, extending beyond simple resource gathering. Unlike traditional fishing, SoD’s iteration offers unique mechanics and substantial rewards, making it a viable path to gold and progression. Fishing doesn’t necessitate combat, allowing for relaxed gameplay, and crucially, utilizes Level of Detail (LODs) to access previously unreachable fishing spots.

Beyond the fish themselves, players can uncover valuable crates containing green items, Mithril, Rune Cloth, potions, and even cooking recipes. This makes fishing a multifaceted profession, appealing to both dedicated anglers and those seeking supplementary income. Prepare to cast your line and discover the hidden depths of SoD!

Why Fish in Season of Discovery?

Fishing in Season of Discovery presents a compelling alternative to combat-focused professions, offering a unique blend of relaxation and reward. It’s an excellent choice for players seeking a less demanding, yet profitable, activity. The profession’s appeal extends beyond simple resource acquisition; crates obtained while fishing contain valuable items like green gear, crafting materials (Mithril and Rune Cloth), and useful potions.

Furthermore, fishing provides ingredients for essential cooking recipes, creating synergy between professions. Avoiding lengthy, unpredictable hours spent fishing is possible with professional boosting services, accelerating skill progression and access to rare catches.

The Economic Value of Fishing

Fishing’s economic potential in Season of Discovery is substantial, often overlooked by players rushing towards combat-oriented gold-making methods. Locations like Tanaris offer lucrative opportunities, being less crowded than hotspots like Stranglethorn Vale and Feralas, resulting in higher yields. The crates received while fishing consistently provide sellable items – green items, bound Mithril, and Rune Cloth – contributing to a steady income stream.

Moreover, the demand for fish used in cooking recipes drives up prices, especially for rarer species. Investing time in fishing, or utilizing a boosting service, can quickly translate into significant WoW SOD Gold.

Essential Fishing Gear & Consumables

Maximize your catches! Selecting the right fishing pole and lures is crucial for efficiency and accessing valuable resources in Season of Discovery.

Fishing Poles

Choosing the right pole is fundamental. While any fishing pole will technically work, upgrading as you level significantly improves your fishing skill and efficiency. Early on, a basic pole from a trainer suffices, but consider investing in better options as gold allows.

Currently, specific pole stats haven’t been heavily emphasized in SoD, but higher skill levels gained through pole upgrades directly translate to faster fishing speeds. Keep an eye on the Auction House for potentially enchanted poles offering minor bonuses, though these are not essential early in the season. Remember that rune interactions can sometimes affect equipped gear, potentially temporarily removing fishing bonuses – a quirk to be aware of!

Lures & Baits

Lures are crucial for boosting your fishing success! Applying a lure, like Bright Baubles, significantly increases your bite rate. Experiment with different lures to discover which performs best in specific zones – some fish may be more attracted to certain types.

Be mindful of rune interactions; shifting into Cat or Bear Form while a lure is equipped can sometimes overwrite the fishing buff, removing the lure’s benefit. Remember to reapply the lure after shifting back. Lures are readily available from vendors or the Auction House, and their cost is generally quite reasonable, making them a worthwhile investment for maximizing your fishing gains.

Fishing Skill-Up Locations — Early Game

Starting your fishing journey? Bloodhoof Village (Horde) and Stormwind (Alliance) are excellent starting points. Both locations conveniently offer a fishing trainer and vendor right near a sizable lake, streamlining the leveling process. These hubs provide easy access to initial quests and resources.

Focus on catching common fish in these areas to quickly gain skill points; While Tanaris, Stranglethorn Vale, and Feralas offer lucrative opportunities later, they’re more competitive. Prioritize efficiency early on; minimizing travel time and maximizing cast opportunities will accelerate your skill progression and prepare you for more challenging, rewarding fishing grounds.

Prime Fishing Locations, Leveling & Profit

Maximize your gains! Tanaris, Stranglethorn Vale, and Feralas are key locations, offering varying levels of competition and potential gold through fishing.

Tanaris: A Hidden Gem

Seeking solitude and profit? Tanaris presents a remarkably lucrative, yet often overlooked, fishing destination. While many players gravitate towards the more popular spots like Stranglethorn Vale and Feralas, Tanaris offers a less competitive environment for dedicated anglers. It’s important to strategically position yourself; the highest drop rates are concentrated between Steamwheedle Port and the mid-section of the zone.

Avoid venturing too far south, towards the area densely populated with turtles, as the fishing yields diminish significantly in that region. This makes Tanaris an excellent choice for consistently earning WoW Season of Discovery gold, providing a calmer experience than the heavily contested zones.

Stranglethorn Vale: Popular but Competitive

Prepare for a battle for prime spots! Stranglethorn Vale is renowned as a highly sought-after fishing location in Season of Discovery, attracting a large number of players eager to capitalize on its potential rewards. However, this popularity comes with a significant drawback: intense competition for the best fishing nodes. Expect frequent interruptions from other anglers vying for the same catches.

Despite the crowded conditions, Stranglethorn Vale remains a viable option for dedicated fishers willing to navigate the challenges. Persistence and strategic positioning are key to maximizing your yield in this bustling zone, though Tanaris offers a less stressful alternative.

Feralas: Another Viable Option

Seeking a balance? Feralas presents itself as a solid, though often overlooked, fishing destination within Season of Discovery. While not as intensely crowded as Stranglethorn Vale, it still attracts a consistent stream of players aiming to amass wealth through aquatic harvests. This moderate level of competition offers a more relaxed experience compared to the Vale’s frantic pace.

Feralas provides a reasonable opportunity for profit, making it a worthwhile consideration for anglers seeking a middle ground between accessibility and reward. It’s a dependable location, though Tanaris currently appears to be the most lucrative hidden gem.

Fishing Mechanics & Rune Interactions

Unique to SoD, rune interactions can disrupt fishing! Shifting into Cat or Bear Form may overwrite your fishing buff, hindering your progress.

Fishing and Rune Overwrites (Cat/Bear Form)

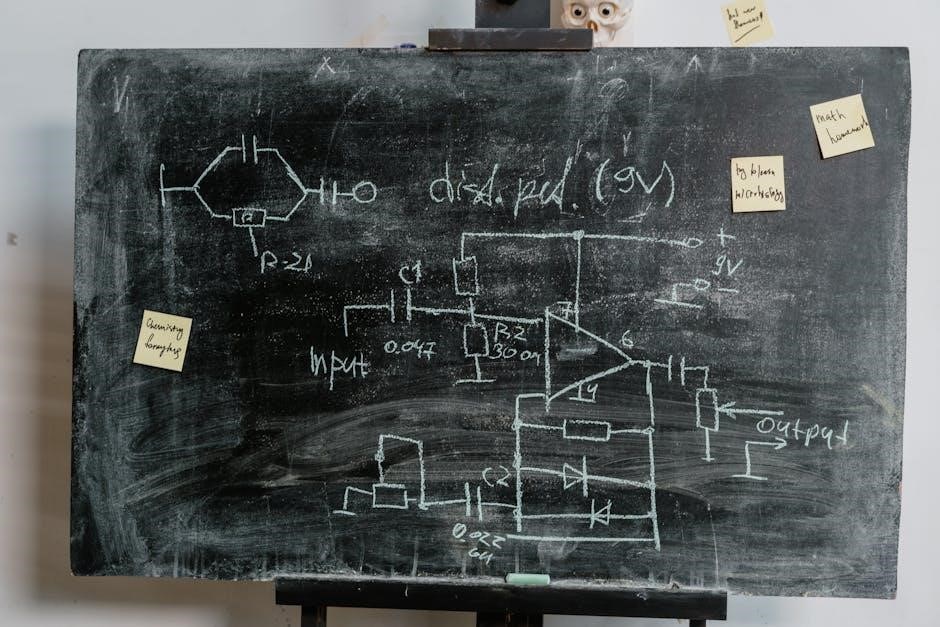

A peculiar interaction exists between fishing and certain rune setups in Season of Discovery. Applying a lure, like Bright Baubles, and then shifting into Cat or Bear Form can cause issues. If your equipped chest rune applies to your weapon – for example, Wild Strikes – it will overwrite the fishing buff currently active on your pole.

This means the fishing bonus is temporarily removed. Upon shifting back to your normal form, the fishing buff unfortunately does not automatically reapply, leaving you fishing at a reduced efficiency until you re-equip or re-apply the lure. Be mindful of this when utilizing rune combinations while angling for valuable catches!

Utilizing LODs for Fishing Access

Level of Detail (LOD) manipulation offers a unique advantage to SoD fishers. Unlike other professions currently limited to a standard 150-unit reach, fishing cleverly bypasses this restriction through LODs. This allows access to fishing spots in areas normally inaccessible, opening up new opportunities for rare catches and increased profits.

By strategically utilizing LODs, players can cast their lines into previously unreachable waters, potentially discovering exclusive fish and valuable resources. This technique expands fishing grounds beyond conventional limits, providing a competitive edge in acquiring sought-after items and maximizing your Season of Discovery gold gains.

Maximizing Fishing Efficiency

Boost services, faction hubs like Bloodhoof Village and Stormwind, and strategic lure usage are key to swiftly leveling and profiting from SoD fishing.

Fishing Boost Services

Are you short on time or find fishing monotonous? Our WoW Season of Discovery Fishing profession boost is the perfect solution! This service bypasses the lengthy, often unpredictable grind of leveling your fishing skill. Experienced boosters will rapidly advance your skill level, allowing you to quickly access the valuable fish crucial for high-end cooking recipes and exclusive rewards found within Season of Discovery’s waters.

Forget endless hours waiting for bites; we accelerate your progression. This means faster access to rare fish, increased gold generation, and the ability to contribute meaningfully to raid or PvP efforts through crafted consumables. Let us handle the grind so you can enjoy the rewards!

Faction-Specific Hubs

Convenience is key when leveling your fishing skill! For Horde players, Bloodhoof Village in Mulgore offers an ideal hub. A fishing trainer and vendor are conveniently located right beside the lake, minimizing travel time for skill-ups and resupplying baits. This streamlined access significantly boosts efficiency during early leveling.

Alliance players will find similar advantages in Stormwind. The city boasts both a fishing trainer and a vendor in close proximity to the water, creating a similarly efficient fishing experience. Utilizing these faction hubs reduces downtime and maximizes your time spent actually fishing, accelerating your path to mastery.

Bloodhoof Village (Horde)

Bloodhoof Village stands out as a premier fishing location for Horde characters in Season of Discovery. Its primary advantage lies in the incredibly convenient placement of essential resources. A dedicated fishing trainer is readily available, allowing for swift skill-up progression without lengthy travel.

Furthermore, a vendor is situated directly beside the lake, enabling quick and easy restocking of lures and baits. This proximity minimizes downtime, maximizing the time spent actively fishing and increasing overall efficiency. The calm atmosphere and readily available services make Bloodhoof Village an ideal starting point for aspiring Horde fishers.

Stormwind (Alliance)

For Alliance players embarking on their Season of Discovery fishing journey, Stormwind provides a remarkably convenient hub. Similar to Bloodhoof Village for the Horde, Stormwind boasts the advantageous combination of a readily accessible fishing trainer and a nearby vendor. This strategic placement streamlines the leveling process, eliminating unnecessary travel time and logistical hurdles.

Alliance fishers can efficiently enhance their skills and replenish supplies without venturing far from the city’s protective walls. The ease of access to both training and resources makes Stormwind an excellent choice for both novice and experienced fishers alike, fostering a productive and enjoyable experience.

What You Can Catch: Fish & Beyond

Fishing yields more than just fish! Expect crates containing green items, mithril, rune cloth, potions, and even valuable cooking recipes in SoD.

Common Fish Species

Numerous fish populate the waters of Azeroth in Season of Discovery, offering varying degrees of value and utility. While specific species and their prevalence shift based on location, several consistently appear throughout your leveling journey. Expect to frequently reel in Devilsaurs, particularly in hotter zones like Tanaris and Un’Goro Crater. These are often used in basic cooking recipes. Stonefish are another common catch, found in coastal areas and providing a steady, if modest, income.

River Gladscales are prevalent in freshwater locations, and Bloodfin Snappers are common in calmer waters. Don’t underestimate these seemingly mundane catches; they form the foundation for many early-game cooking endeavors and contribute to overall profession skill gains. Remember to check vendor prices, as even common fish can add up!

Rare Fish & Their Uses

Beyond the common catches, Season of Discovery’s waters hold rarer, more valuable fish. These aren’t just for show; they’re crucial for advanced cooking recipes and can fetch a hefty price on the auction house. While specifics are still emerging, players have reported increased encounters with unique species in less-populated zones like Tanaris. These rare fish often serve as key ingredients for powerful buffs and consumables.

Expect to utilize these catches for specialized cooking quests and to fulfill demands from players seeking specific stat boosts. Keep an eye out for announcements regarding new rare fish discoveries, as their value can fluctuate dramatically with demand. Patience and persistence are key to landing these prized catches!

Fishing Crates: Loot & Rewards

Fishing in Season of Discovery isn’t solely about the fish themselves! A significant draw is the chance to reel in fishing crates, brimming with valuable rewards. These crates offer a diverse range of loot, extending far beyond simple gold. Players consistently report finding green items suitable for equipping or disenchanting, alongside essential crafting materials like Mithril and highly sought-after Rune Cloth.

Furthermore, crates frequently contain useful potions and even rare cooking recipes, providing a boost to your character’s progression. The contents are randomized, adding an element of excitement to each catch, making fishing a consistently rewarding endeavor.

Green Items from Crates

Fishing crates in Season of Discovery frequently yield green-quality items, offering a valuable source of gear for leveling characters or providing materials for profitable disenchanting. While not the highest tier of equipment, these items represent a significant bonus alongside the primary goal of acquiring fish and crafting resources. Players have reported finding a variety of armor pieces, weapons, and accessories within these crates.

Disenchanting these green items yields valuable materials, contributing to the overall economic benefits of fishing. This makes crate fishing a worthwhile pursuit even for characters already well-equipped, offering a consistent source of income.

Mithril & Rune Cloth

Fishing crates consistently provide Mithril ore and, crucially, Rune Cloth – highly sought-after materials in Season of Discovery. Mithril is essential for crafting various items, while Rune Cloth is a core component in creating powerful Runes, the defining feature of this season. These materials significantly boost the profitability of fishing beyond simply selling the fish themselves.

The demand for Rune Cloth remains high as players experiment with different Rune combinations. Regularly fishing and opening crates ensures a steady supply of this valuable resource, allowing players to capitalize on market opportunities and contribute to the evolving meta.

Potions & Recipes

Fishing crates aren’t limited to materials; they also yield valuable potions and, more importantly, cooking recipes! These recipes are crucial for maximizing the synergy between fishing and cooking, allowing players to create powerful consumables. Discovering rare recipes through fishing provides a competitive edge and opens up new avenues for profit.

The potions found within crates offer immediate benefits, aiding in leveling or providing temporary stat boosts. Combining these potions with expertly crafted meals from the acquired recipes creates a potent combination for any adventurer in Season of Discovery.

Cooking & Fishing Synergy

Fishing provides essential ingredients for cooking, and acquiring rare recipes from crates unlocks powerful consumables, boosting stats and overall gameplay effectiveness.

Essential Cooking Recipes

Season of Discovery introduces unique cooking demands, with recipes requiring fish caught through dedicated fishing efforts. Prioritize recipes offering substantial stat boosts or unique effects, enhancing your character’s capabilities in both PvE and PvP content. Look for recipes obtainable from fishing crates – these often contain valuable, otherwise hard-to-find formulas.

Specifically, focus on recipes that complement Rune-enhanced builds. For example, a recipe increasing critical strike chance synergizes well with certain offensive Runes. Regularly check auction house prices to identify recipes yielding high-demand, profitable dishes. Mastering these recipes transforms your fishing spoils into a significant gold source, further incentivizing your angling pursuits.

Fishing for Cooking Ingredients

Fishing isn’t just about gold; it’s a vital supply chain for cooking! Season of Discovery’s cooking recipes frequently demand specific fish species, making fishing a core component of culinary mastery. Tanaris, Stranglethorn Vale, and Feralas offer diverse catches, each suited to different recipes.

Prioritize locations based on the fish needed for your desired dishes. Remember that fishing crates also yield ingredients, alongside recipes. Efficiently managing your fishing rotations and utilizing appropriate lures maximizes your ingredient acquisition. This synergy between fishing and cooking creates a self-sufficient system, boosting both professions and your character’s overall power.

Advanced Fishing Techniques

Mastering lure optimization and understanding bite rates are crucial for efficient fishing. Utilize LODs and be aware of rune interactions impacting your success!

Optimizing Lure Usage

Selecting the right lure is paramount for maximizing your fishing efficiency in Season of Discovery. While specific lure effectiveness varies by location and fish type, consistently applying any lure significantly increases your bite rate compared to fishing without one. Bright Baubles are a commonly recommended starting point, offering a general boost.

However, advanced players should experiment with different lures to identify those best suited for specific zones and desired catches; Remember the peculiar interaction: applying a lure and then shifting into Cat or Bear Form can cause the fishing buff to be overwritten if your chest rune applies to your weapon. Always re-apply the lure after shifting back to your normal form to maintain the bonus!

Understanding Bite Rates

Bite rates in Season of Discovery fishing aren’t static; they fluctuate based on location, lure usage, and potentially even server population. Generally, less-contested zones like Tanaris exhibit higher bite rates than hotspots like Stranglethorn Vale, where competition is fierce. Utilizing a lure consistently improves your chances, but understanding the underlying mechanics is crucial.

While precise bite rate data is scarce, observation and experimentation are key. Pay attention to how quickly your bobber dips, and adjust your strategy accordingly. Remember that rune interactions, specifically shifting forms with equipped runes, can inadvertently remove your fishing buff, effectively halting bites until re-applied.

Troubleshooting Common Fishing Issues

Encountering problems? This section addresses competition for prime spots, lost poles, and rune-related bugs impacting your fishing experience in SoD.

Dealing with Competition

Competition is fierce! Popular fishing zones like Stranglethorn Vale quickly become crowded, impacting your catch rates. Tanaris offers a less-contested alternative, proving remarkably lucrative due to lower player density. Consider off-peak hours for better results. Utilizing Layering (if available) can also help distribute players across different instances of the zone, reducing immediate competition.

Remember, patience is key. Don’t be discouraged by others; consistently scouting for available nodes and adapting your location can significantly improve your fishing success. Explore less obvious areas within prime zones – sometimes a slight shift in location can make all the difference.

Lost Fishing Poles

Misplaced your pole? It happens! Fishing, while generally safe, doesn’t entirely eliminate the risk of losing your equipment. While not explicitly detailed, accidental dismounts or unforeseen environmental interactions could lead to a lost pole. Always fish in relatively safe areas, avoiding aggressive mobs or precarious ledges.

Unfortunately, there’s no automated retrieval system. If you suspect your pole is stuck, try repeatedly casting in the immediate vicinity; If unsuccessful, consider contacting a guildmate or utilizing the in-game help system. A replacement pole is a relatively minor expense, but prevention is always preferable!